Welcome to Debate Club! Please be aware that this is a space for respectful debate, and that your ideas will be challenged here. Please remember to critique the argument, not the author.

Should junk food be taxed?

Replies

-

GaleHawkins wrote: »Prohibition by taxation historically is not that effective. There are too many lobby dollars for 'junk' food to likely ever be legally defined. The trend to withhold medical services to people with bad health habits may been more effective in saving taxpayers money perhaps.

You mean like people who eat at McDonalds regularly and only walk 1/4 mile a day?11 -

16 months and 60 pages later, and the best answers are still on page 1. Until someone can measurably qualify the value of food the question is moot. And if you were to achieve that, I'm yet to see clear evidence of taxation alone leading to significant change in a trend or popular pursuit.

There have been some initiatives, like what Germany has done with it's packaging laws that appear to have been widely successful. In this instance, charging a food manufacturer a public health levy on a sliding scale depending on the percentage of sugar or sodium in their product. You just might find companies finding a way to put less sugar in product x despite what the focus groups say.2 -

Alatariel75 wrote: »GaleHawkins wrote: »Prohibition by taxation historically is not that effective. There are too many lobby dollars for 'junk' food to likely ever be legally defined. The trend to withhold medical services to people with bad health habits may been more effective in saving taxpayers money perhaps.

You mean like people who eat at McDonalds regularly and only walk 1/4 mile a day?

I believe that sort of habit would contribute to dementia and premature death.

6 -

It would reduce consumption without eliminating it entirely. The money raised from such a tax should be used to mitigate negative externalities, mainly, pay for public health care.

I have a novel idea - encourage citizens to be self-sufficient and pay for their own health care, instead of encouraging them to lean on the government for everything, which creates a disincentive to be accountable for their own health habits.

Besides, there's no evidence a moderate tax would reduce obesity significantly. People will still eat too much and not move enough. Sales tax on non-food items here is almost 9% and people still buy way too much stuff they don't need.5 -

Cherimoose wrote: »It would reduce consumption without eliminating it entirely. The money raised from such a tax should be used to mitigate negative externalities, mainly, pay for public health care.

I have a novel idea - encourage citizens to be self-sufficient and pay for their own health care, instead of encouraging them to lean on the government for everything, which creates a disincentive to be accountable for their own health habits.

Because a person's health benefits only themselves, apparently?

A healthy population is a public good and therefore ought to be supported. Similar to education.3 -

If you're on some sort of welfare, you have no healthcare cost. Others are paying for you via their taxes. Unless you're disabled and unable to work, having free healthcare isn't something to be proud of.6 -

Packerjohn wrote: »

If you're on some sort of welfare, you have no healthcare cost. Others are paying for you via their taxes. Unless you're disabled and unable to work, having free healthcare isn't something to be proud of.

Or you live in a country, such as the UK, where healthcare is free at point of service to everyone (yes it's paid via taxes and I think comment was sarcastic because of course it is paid for somewhere down the line).

Not everyone lives in the USA and needs health insurance, this is a worldwide site.6 -

VintageFeline wrote: »Packerjohn wrote: »

If you're on some sort of welfare, you have no healthcare cost. Others are paying for you via their taxes. Unless you're disabled and unable to work, having free healthcare isn't something to be proud of.

Or you live in a country, such as the UK, where healthcare is free at point of service to everyone (yes it's paid via taxes and I think comment was sarcastic because of course it is paid for somewhere down the line).

Not everyone lives in the USA and needs health insurance, this is a worldwide site.

If you are paying taxes into a system that provides healthcare for the population with those taxes, the healthcare is not free.

I'm well aware there is international access to this site.6 -

Packerjohn wrote: »

If you're on some sort of welfare, you have no healthcare cost. Others are paying for you via their taxes. Unless you're disabled and unable to work, having free healthcare isn't something to be proud of.

Au contraire, Free healthcare is a wonderful thing and the hallmark of an evolved society. Living in a place where people can't afford basic care or spend most of their adult lives paying off a hospital bill. That is something to not be proud of. Free healthcare is literally the best reason to even have taxes. I pay my taxes and I enjoy my healthcare when I need it.

And yes, VintageFeline hit the nail on the head.6 -

Packerjohn wrote: »

If you're on some sort of welfare, you have no healthcare cost. Others are paying for you via their taxes. Unless you're disabled and unable to work, having free healthcare isn't something to be proud of.

Au contraire, Free healthcare is a wonderful thing and the hallmark of an evolved society. Living in a place where people can't afford basic care or spend most of their adult lives paying off a hospital bill. That is something to not be proud of. Free healthcare is literally the best reason to even have taxes. I pay my taxes and I enjoy my healthcare when I need it.

And yes, VintageFeline hit the nail on the head.

Then it is not free. If you didn't have government funded heath care your tax bill could be less, and you'd have more money in your pocket. You are paying for it, the payment is just in a different form.

Claiming healthcare or anything else that requires resources is "free" is a naive viewpoint IMO.6 -

VintageFeline wrote: »Packerjohn wrote: »

If you're on some sort of welfare, you have no healthcare cost. Others are paying for you via their taxes. Unless you're disabled and unable to work, having free healthcare isn't something to be proud of.

Or you live in a country, such as the UK, where healthcare is free at point of service to everyone (yes it's paid via taxes and I think comment was sarcastic because of course it is paid for somewhere down the line).

Not everyone lives in the USA and needs health insurance, this is a worldwide site.

I'm aware of this. But you still pay for it.6 -

I'm in Ontario, Canada. Junk food is already kind of taxed. Not in the way that junk food has it's own specific tax but that "normal" grocery foods aren't taxed at all. Anything considered a snack food has HST.1

-

Americas obesity problem has become a national security threat.

A 2014 study found that an appalling 71% of 17-24 year olds were ineligible for military service. Mostly because they were too fat.

America's widespread obesity problems, poor access to healthcare, and overall toxic lifestyle choices are a drain on our economy and a real threat to our security.

America is fat. Fat as *kitten*. The government has a moral responsibility to intervene any way possible. More control over school lunches, more PT in the school curriculum, punitive taxes on junk food, fast food, and soda, tax penalties for obesity, tax credits for good health. All of it. I support all of it. At a national level. State and local governments are incompetent, corrupt, and fickle, and generally can't be trusted to tie their own shoes let alone protect their citizens.5 -

Absolutely not. What I eat isn't the nanny state's business.2

-

Packerjohn wrote: »If you didn't have government funded heath care your tax bill could be less, and you'd have more money in your pocket.

Do you actually believe that? or did you hit your head when you fell off your high horse back there lol? Here's a fun fact for you. When you compare countries by income tax rates. Our countries are side by side on the big list.

2 -

Packerjohn wrote: »If you didn't have government funded heath care your tax bill could be less, and you'd have more money in your pocket.

Do you actually believe that? or did you hit your head when you fell off your high horse back there lol? Here's a fun fact for you. When you compare countries by income tax rates. Our countries are side by side on the big list.

I'm sure you're disappointed but my head is just fine as I never fell off a horse. My point was if fewer services are provided by the government, the taxes can be lower all else remaining the same. My point wasn't to compare US and GB tax rates.

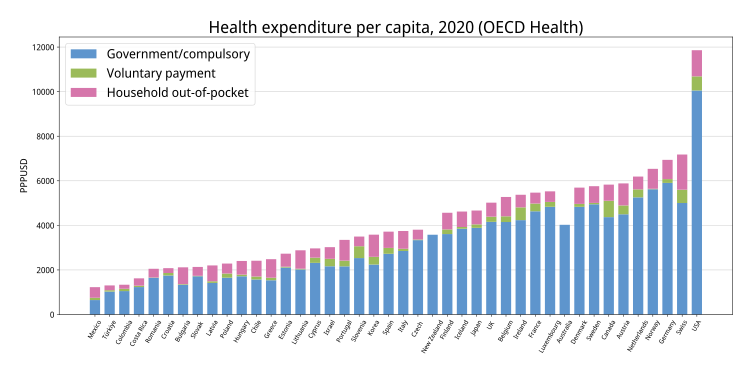

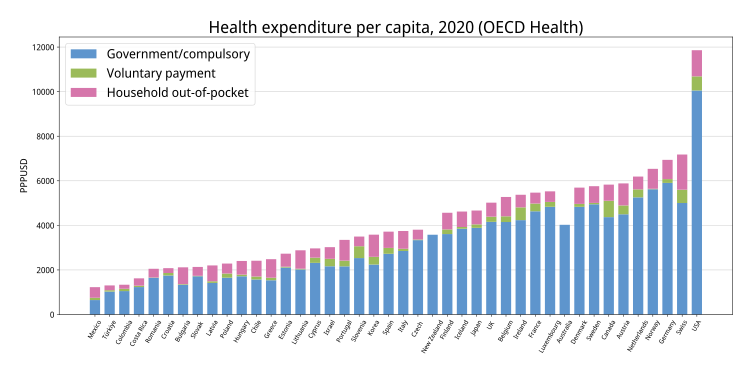

However, if you want to do a comparison, you will find the total tax burden for the US is significantly lower than most OECD countries.

"A research paper published this week by the Federal Reserve Bank of Chicago includes the above chart, highlighting the tax burdens of all 35 OECD countries as of 2014. With a tax burden of 25% -- a measurement that includes income, property, and various other taxes -- the U.S. is near the very bottom, well below the overall average of 34%. It ranks below all the measured countries except Korea, Chile, and Mexico."

http://time.com/money/4862673/us-tax-burden-vs-oecd-countries/4 -

@Packerjohn Wow, only 2% greater tax burden for a completely funded national healthcare. Thats a bargain. I'm in Australia btw.

Lets go to the charts then. Here's a slice of reality to chew on. All the absence of a public health system does is create a corporate profit driven monster that drives the cost of healthcare to ridiculous heights.

A tetanus shot and a bandage shouldn't cost $700 lol. A snake bite shouldn't cost someone $153000. It's a scam. The entire US healthcare industry is less healthy than a patients bank balance. The biggest irony is more of your taxes go towards your health system than mine. And when I get wheeled out of a hospital, all I have to worry about is getting a lift home.

Anyway, at this point we are just hijacking a thread about junk food. But there is such a thing as free healthcare. And if some of my taxes go to looking after someone who can't afford it. I'm cool with that.2 -

@Packerjohn Wow, only 2% greater tax burden for a completely funded national healthcare. Thats a bargain. I'm in Australia btw.

Lets go to the charts then. Here's a slice of reality to chew on. All the absence of a public health system does is create a corporate profit driven monster that drives the cost of healthcare to ridiculous heights.

A tetanus shot and a bandage shouldn't cost $700 lol. A snake bite shouldn't cost someone $153000. It's a scam. The entire US healthcare industry is less healthy than a patients bank balance. The biggest irony is more of your taxes go towards your health system than mine. And when I get wheeled out of a hospital, all I have to worry about is getting a lift home.

Anyway, at this point we are just hijacking a thread about junk food. But there is such a thing as free healthcare. And if some of my taxes go to looking after someone who can't afford it. I'm cool with that.

I'm in no way defending the US healthcare system, IMO it's a cluster *kitten*. Just correcting the statement that healthcare is free. You pay for your healthcare in taxes, don't pay at point of service and say that heathcare is free. In the US you can buy a policy with $0 deductibles and co-payments. You don't pay a penny a point of service. Is heathcare free in that model? Of course not, just like it isn't free in the Australian model.5 -

Packerjohn wrote: »Packerjohn wrote: »If you didn't have government funded heath care your tax bill could be less, and you'd have more money in your pocket.

Do you actually believe that? or did you hit your head when you fell off your high horse back there lol? Here's a fun fact for you. When you compare countries by income tax rates. Our countries are side by side on the big list.

I'm sure you're disappointed but my head is just fine as I never fell off a horse. My point was if fewer services are provided by the government, the taxes can be lower all else remaining the same. My point wasn't to compare US and GB tax rates.

However, if you want to do a comparison, you will find the total tax burden for the US is significantly lower than most OECD countries.

"A research paper published this week by the Federal Reserve Bank of Chicago includes the above chart, highlighting the tax burdens of all 35 OECD countries as of 2014. With a tax burden of 25% -- a measurement that includes income, property, and various other taxes -- the U.S. is near the very bottom, well below the overall average of 34%. It ranks below all the measured countries except Korea, Chile, and Mexico."

http://time.com/money/4862673/us-tax-burden-vs-oecd-countries/

And that little bit extra money in your pocket is sure going to come in handy when s*** goes down and you're stuck with a huge hospital bill you can't hope to afford. About 10% of the US population is not health insured for one reason or another. Before obamacare it was worse. In Germany it's 0.1%1 -

Saying that healthcare is not free, which of course it is not, not anywhere (and should not be, as care costs money, period), is not the same thing as saying that the US system is better (which I think it's not, I agree that it makes it more expensive than in countries with more fully-funded healthcare, in fact).

Things that (many) people in the US mistakenly believe: that our healthcare is better than in other countries because not "socialized" and that it's cheaper than in other countries because not "socialized." How good it is is debatable because different countries emphasize different things and there are always trade-offs, but I see no evidence that care in, say, France, Germany, the Netherlands, and the UK (for just a few examples) are not at least on a par with the US. Cost is clearer -- overall cost is higher in the US (even though it's not covered in the same way).

That said, saying that Australian taxes are only 2% more than in the US so that's the cost of health care to the tax payer is, of course, absurd, as there are lots of things taxes cover (and a large part of ours ARE healthcare related, obviously, including the most expensive part, that for old people) and you can't do a one to one comparison. For one obvious difference, military spending. (Then again, if we covered health care through taxes, that would be spending that lots of people wouldn't have to pay for otherwise, and the question is whether all the people who get it as part of current compensation get salary increases that make up for it -- IMO, largely, yes, and if not that's a cost savings that ought to otherwise be beneficial to the businesses.)4 -

Americas obesity problem has become a national security threat.

A 2014 study found that an appalling 71% of 17-24 year olds were ineligible for military service. Mostly because they were too fat.

America's widespread obesity problems, poor access to healthcare, and overall toxic lifestyle choices are a drain on our economy and a real threat to our security.

America is fat. Fat as *kitten*. The government has a moral responsibility to intervene any way possible. More control over school lunches, more PT in the school curriculum, punitive taxes on junk food, fast food, and soda, tax penalties for obesity, tax credits for good health. All of it. I support all of it. At a national level. State and local governments are incompetent, corrupt, and fickle, and generally can't be trusted to tie their own shoes let alone protect their citizens.

I am personally open to the negative externalities approach (I think it makes sense in a lot of areas), but IMO it's just politically a non-starter and difficult with cheap food items anyway, so knowing that what would you actually propose as a start that might actually have some chance of succeeding? (I'm not denying that you list off a lot of things here, but think of it in terms of a political proposal that could become popular enough to pass on the federal level, even given our federal gov't. I'm cynical/not hopeful, but maybe you can convince me.)1 -

stevencloser wrote: »Packerjohn wrote: »Packerjohn wrote: »If you didn't have government funded heath care your tax bill could be less, and you'd have more money in your pocket.

Do you actually believe that? or did you hit your head when you fell off your high horse back there lol? Here's a fun fact for you. When you compare countries by income tax rates. Our countries are side by side on the big list.

I'm sure you're disappointed but my head is just fine as I never fell off a horse. My point was if fewer services are provided by the government, the taxes can be lower all else remaining the same. My point wasn't to compare US and GB tax rates.

However, if you want to do a comparison, you will find the total tax burden for the US is significantly lower than most OECD countries.

"A research paper published this week by the Federal Reserve Bank of Chicago includes the above chart, highlighting the tax burdens of all 35 OECD countries as of 2014. With a tax burden of 25% -- a measurement that includes income, property, and various other taxes -- the U.S. is near the very bottom, well below the overall average of 34%. It ranks below all the measured countries except Korea, Chile, and Mexico."

http://time.com/money/4862673/us-tax-burden-vs-oecd-countries/

And that little bit extra money in your pocket is sure going to come in handy when s*** goes down and you're stuck with a huge hospital bill you can't hope to afford. About 10% of the US population is not health insured for one reason or another. Before obamacare it was worse. In Germany it's 0.1%

Assuming you didn't see my most right above this response. Here it is:

I'm in no way defending the US healthcare system, IMO it's a cluster *kitten*. Just correcting the statement that healthcare is free. You pay for your healthcare in taxes, don't pay at point of service and say that heathcare is free. In the US you can buy a policy with $0 deductibles and co-payments. You don't pay a penny a point of service. Is heathcare free in that model? Of course not, just like it isn't free in the Australian model.1 -

Junk food is taxed. Taxed by our health. You won't get away with eating it forever, then you will certainly be paying for it physically and financially.9

-

I think it is already taxed in Canada. our grocery's don't get taxed if I remember right. but I could be wrong. I can walk into a grocery store pick up carrots and potato chips and the only thing taxed is the chips0

-

bgctrinity wrote: »Junk food is taxed. Taxed by our health. You won't get away with eating it forever, then you will certainly be paying for it physically and financially.

Care to add any context or dosage to these vague statements?5 -

clicketykeys wrote: »Cherimoose wrote: »I have a novel idea - encourage citizens to be self-sufficient and pay for their own health care, instead of encouraging them to lean on the government for everything, which creates a disincentive to be accountable for their own health habits.

Because a person's health benefits only themselves, apparently?

A healthy population is a public good and therefore ought to be supported.

I don't have a problem with a small safety net, but the vast majority of people are able to pay their own way. Again, Americans are less likely to make healthy choices when someone else is paying for the cost of not making healthy choices.Americas obesity problem has become a national security threat.

A 2014 study found that an appalling 71% of 17-24 year olds were ineligible for military service. Mostly because they were too fat.

Our military is equally fat, with way too many soldiers, and troops in 150 other countries. Pull some of their funding and spend it on domestic issues.

Anyway, people aren't obese from the type of food they eat, they're obese from being in a slight calorie surplus. Most people can reverse that simply by eating 100-200 calories less, without changing the type of foods they eat. A less coercive solution than taxing fat people is to ask food manufacturers to package snacks & sodas in smaller containers. They'll happily comply because it increases profits.

0 -

A well considered and defined tax with a designation of the proceeds for public health education and scientific research into human nutrition? Why not? We now pick and choose what to tax and what not to tax. How about taxing sugared sodas but not toilet paper, sanitary supplies, etc.?1

This discussion has been closed.

Categories

- All Categories

- 1.4M Health, Wellness and Goals

- 397K Introduce Yourself

- 44.2K Getting Started

- 260.9K Health and Weight Loss

- 176.3K Food and Nutrition

- 47.6K Recipes

- 232.8K Fitness and Exercise

- 456 Sleep, Mindfulness and Overall Wellness

- 6.5K Goal: Maintaining Weight

- 8.7K Goal: Gaining Weight and Body Building

- 153.3K Motivation and Support

- 8.3K Challenges

- 1.3K Debate Club

- 96.5K Chit-Chat

- 2.6K Fun and Games

- 4.6K MyFitnessPal Information

- 16 News and Announcements

- 18 MyFitnessPal Academy

- 1.4K Feature Suggestions and Ideas

- 3.1K MyFitnessPal Tech Support Questions